ADVANCED FEDERATED LEARNING FOR INSURANCE APPLICATIONS

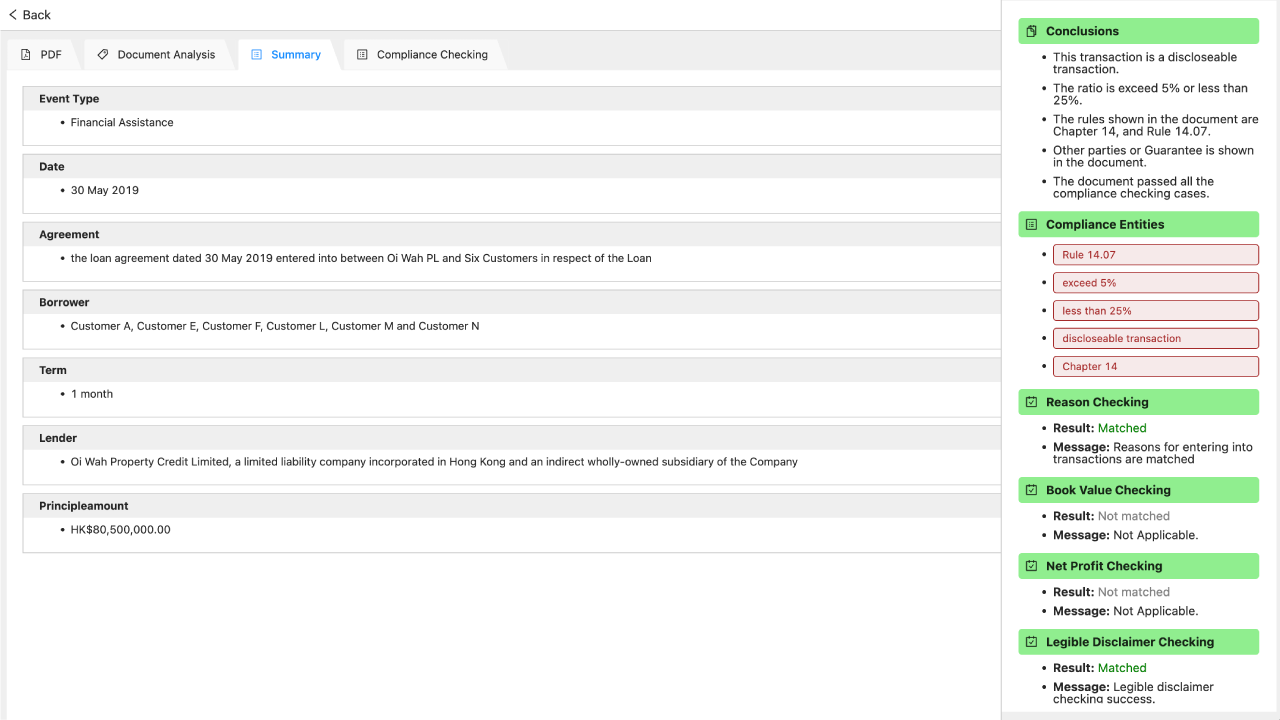

Insurance companies' adoption of alternative risk assessment reflects a broader financial industry trend toward data-driven decisions, fueled by large datasets and advanced analytics. This approach enhances risk assessment accuracy by using diverse data—like transactional/behavioral info—for a holistic risk profile, surpassing traditional limited-data methods.

Traditional insurance risk assessment methods rely on limited data, missing critical insights and leading to incomplete risk profiles. Alternative approaches address this by incorporating diverse data—such as transactional and behavioral information—to deliver more accurate, holistic risk evaluations.

- Confidential Identity Matching Module (CIMM) with functional verification (level of guessing confidence < 0.6).

- Fast Training Strategy Module (FTSM) and speed verification (ratio of speed improvement > 5 times) achieving as much as 17 times comparing to previous Homomorphic Encryption approach.

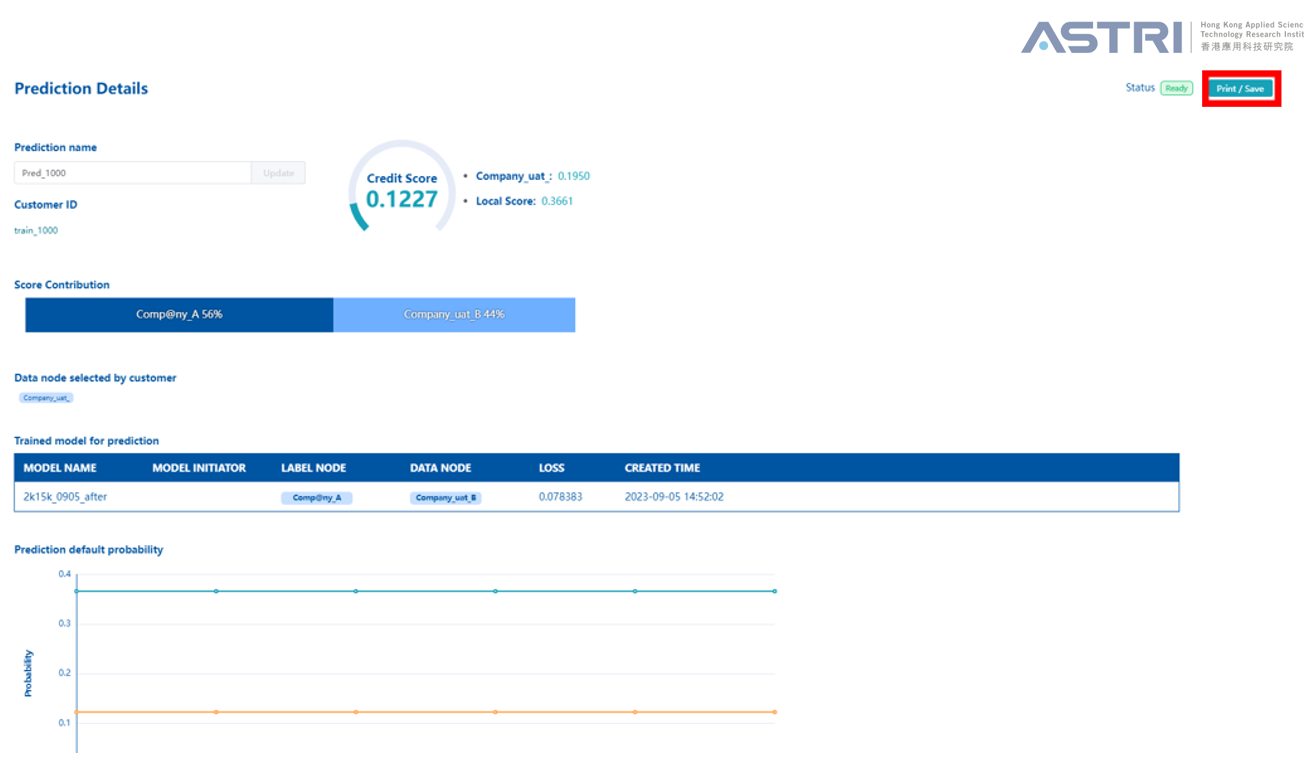

- Multi-machine-learning module (MMLM) and accuracy verification (ratio of accuracy improvement > 12%) achieving as much as 18% improvement comparing to conventional Logistic Regression.

- Ensures secure, privacy-preserving identity verification with <0.6 guessing confidence, minimizing unauthorized access risks. Enhances trust in sensitive systems (e.g., finance, healthcare) by enabling accurate, confidential matching while reducing probabilistic exploitation of identity data.

- Delivers 5–17x speed improvements in homomorphic encryption training, drastically cutting computational latency. Accelerates real-time applications (e.g., encrypted analytics, federated learning) by optimizing model training efficiency without compromising security, making large-scale encrypted datasets more actionable.

- Boosts prediction accuracy by 12–18% over conventional logistic regression through hybrid ML frameworks. Enables more precise insights in complex scenarios (e.g., fraud detection, risk assessment) by integrating diverse algorithms, ensuring robust performance across datasets and outperforming single-model approaches.

- Comprehensive risk analysis, sensitive information matching, authentication applications: minimize exposure to sensitive data

- Accelerate the training speed of federated learning systems, realize federated learning, and enable the application and deployment of large-scale encrypted datasets

- Improve the prediction ability of the federated learning system and provide more accurate reference in complex scenarios

Hong Kong Applied Science and Technology Research Institute (ASTRI) was founded by the Government of the Hong Kong Special Administrative Region in 2000 with the mission of enhancing Hong Kong’s competitiveness through applied research. ASTRI’s core R&D competence in various areas is grouped under four Technology Divisions: Trust and AI Technologies; Communications Technologies; IoT Sensing and AI Technologies and Integrated Circuits and Systems. It is applied across six core areas which are Smart City, Financial Technologies, New-Industrialisation and Intelligent Manufacturing, Digital Health, Application Specific Integrated Circuits and Metaverse.