Smart Credit Assessment & Analytics for Micro, Small & Medium Enterprises Financing

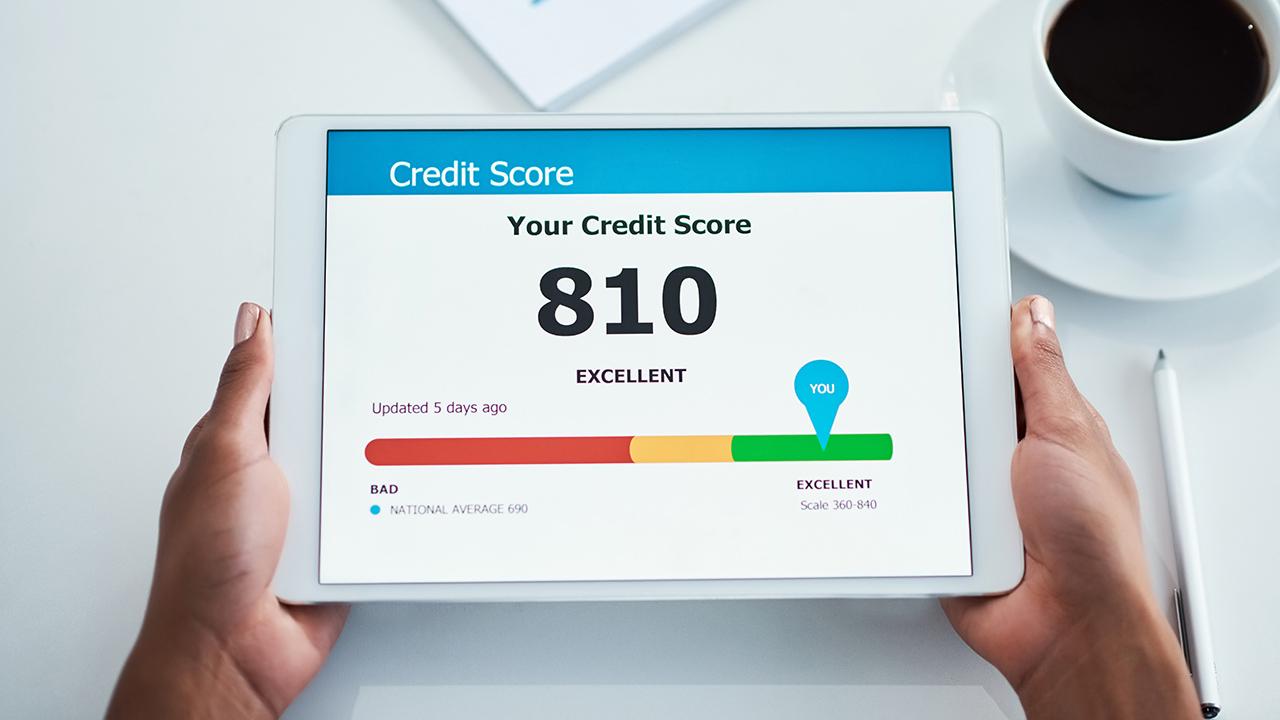

Traditional credit scoring relies on the financial information provided by the loan applicants, but MSME lack sufficient credit history and readily available financial records. Banks may find it difficult to assess their creditworthiness. In view of this, ASTRI conducted a study and explored the use of financial technologies to develop an alternative credit scoring. It can produce credit scores for MSME based on both alternative and conventional data.

- The challenge of traditional credit scoring which relies on the financial information provided by the loan applicants of micro, small & medium-sized enterprises (MSME), such as financial statements.

- The challenge of MSME who may not have sufficient credit history and readily available financial records. Without such data and visibility of their business operations, it may be difficult for banks to assess their creditworthiness which impedes their business expansion.

- The cost concern of Banks who find the assessment of creditworthiness for MSME not cost-effective.

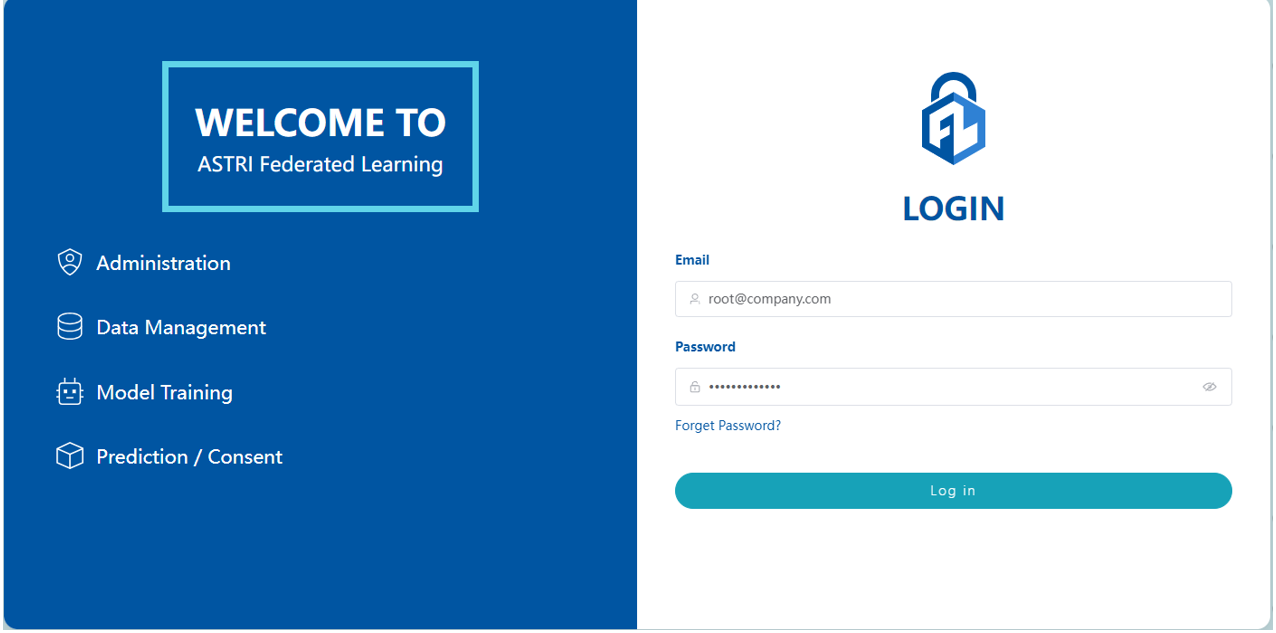

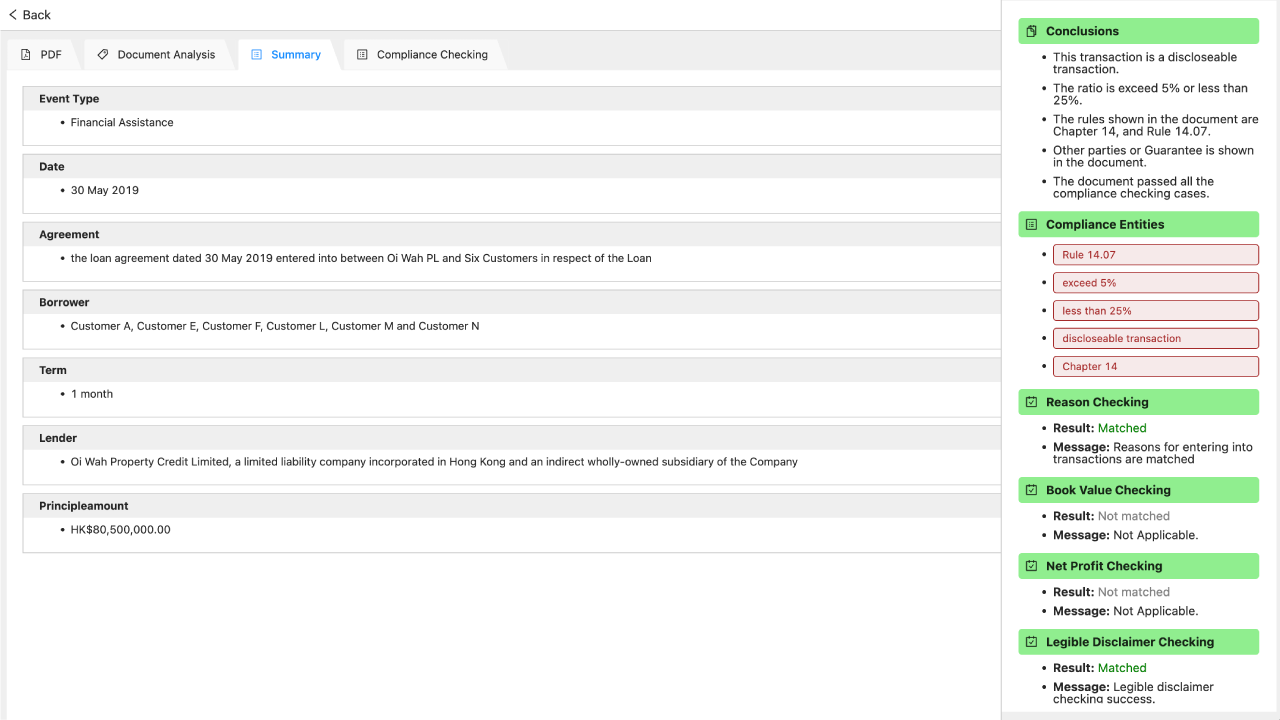

- An alternative credit scoring platform with smart engines that produce credit scores for MSME based on both alternative and conventional data.

- An online document processing engine using AI-based optical character recognition technology

- A data analytics engine for credit assessment using conventional data

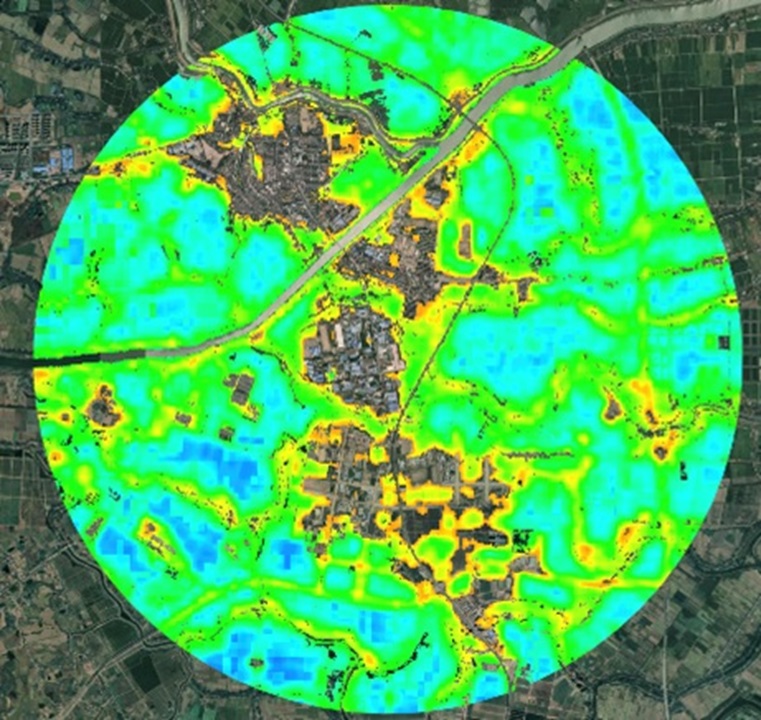

- An alternative credit assessment engine for implementing the newly proposed framework of alternative credit scoring

- A communication infrastructure for connecting strategic data partners to collect information for the analysis of alternative credit assessment

- A cost-effective way for financial institutions to analyze and identify the creditworthiness of MSME

- An automatic credit underwriting platform that supports continuous assessments of MSME

- An innovative approach in using alternative data from different data partners of banks to perform alternative credit scoring

- Credit scoring for MSME financing

Patent

- US App. No. 17/344,893, CN App. No. 202180001789.0 and HK App. No. 62022045702.7

Hong Kong Applied Science and Technology Research Institute (ASTRI) was founded by the Government of the Hong Kong Special Administrative Region in 2000 with the mission of enhancing Hong Kong’s competitiveness through applied research. ASTRI’s core R&D competence in various areas is grouped under four Technology Divisions: Trust and AI Technologies; Communications Technologies; IoT Sensing and AI Technologies and Integrated Circuits and Systems. It is applied across six core areas which are Smart City, Financial Technologies, New-Industrialisation and Intelligent Manufacturing, Digital Health, Application Specific Integrated Circuits and Metaverse.